2025's Best No Credit Check Loan Options (and Why You Should Be Careful) - Hoverday

Instant Cash Loans With No Credit Check: Funds for Emergency Situations With High Approval Rate, Guaranteed to Work Right Now

/EIN News/ -- DALLAS, May 20, 2025 (GLOBE NEWSWIRE) -- No credit check loans introduce Hoverday’s innovative financial pathway for consumers facing credit challenges in 2025. Our streamlined lending solutions deliver rapid funding approval without conventional credit score barriers, empowering customers to address urgent financial needs with confidence. Hoverday’s no credit check loan from direct lenders products feature transparent fee structures reflecting our risk-based approach, with flexible funding options from $100 to $5,000 tailored to verified income parameters and individual financial circumstances. Especially borrowers who need emergency loans with bad credit with almost guaranteed approval.

Best 5 No Credit Check Loan Providers in 2025

- GreendayOnline offers fast approval with minimal documentation requirements, making them a top choice for no credit check loans when traditional lenders turn you away.

- PaydayPact’s flexible options allow borrowers to get a quick cash loan no credit check with same-day funding potential for urgent financial needs.

- GadCapital provides emergency funding solutions designed specifically for those seeking a cash loan today with no credit check with straightforward application processes.

- PaydayChampion specializes in immediate funding with competitive rates on their instant cash loan no credit check products for unexpected expenses.

-

PaydayPeek’s accessible solutions are ideal for consumers looking for cash loans for bad credit without the typical barriers of traditional lending institutions.

Borrowers must exercise caution when seeking a cash advance loan with no credit or a payday loan no credit check, as these products can lead to debt cycles if not managed responsibly. Before applying for a no credit check personal loan, carefully review all terms, confirm the lender’s legitimacy, and ensure repayment capability. Alternative options like secured loans, credit union products, or no credit check installment loan arrangements through community assistance programs often provide safer terms than standard offers from online lenders.

Key Points For No Credit Check Loans

-

No credit check loans do not require a traditional credit report check.

This makes them accessible to people with poor or no credit history. -

No credit loans are often approved quickly—sometimes within minutes.

Personal, installment and payday loans designed for emergency financial needs. -

Common types include payday loans, title loans, and installment loans.

Each has different risks and repayment structures. -

Lenders rely on income proof or bank statements instead of credit scores.

Your employment status or regular deposits may determine approval. -

Interest rates are usually very high compared to traditional loans.

Some payday loans have APRs in the triple digits. -

Loan amounts are typically small—ranging from $100 to $5,000.

These are short-term financial solutions, not long-term fixes. -

Repayment periods are often short, sometimes as little as two weeks.

Missing payments can lead to fees and rollovers. -

No credit check loans can create a cycle of debt if not managed carefully.

Borrowers should only take them when absolutely necessary. -

Reputable lenders will be transparent about fees and repayment terms.

Always read the fine print and avoid predatory practices.

Top 5 No Credit Check Loans Providers That Prioritize Fast Approval in 2025

Finding reliable no credit check loans can be challenging, especially when you need money quickly with a same day deposit.

I’ve researched extensively to identify the top providers that offer fast approval in 2025, focusing on companies that balance accessibility with responsible lending practices.

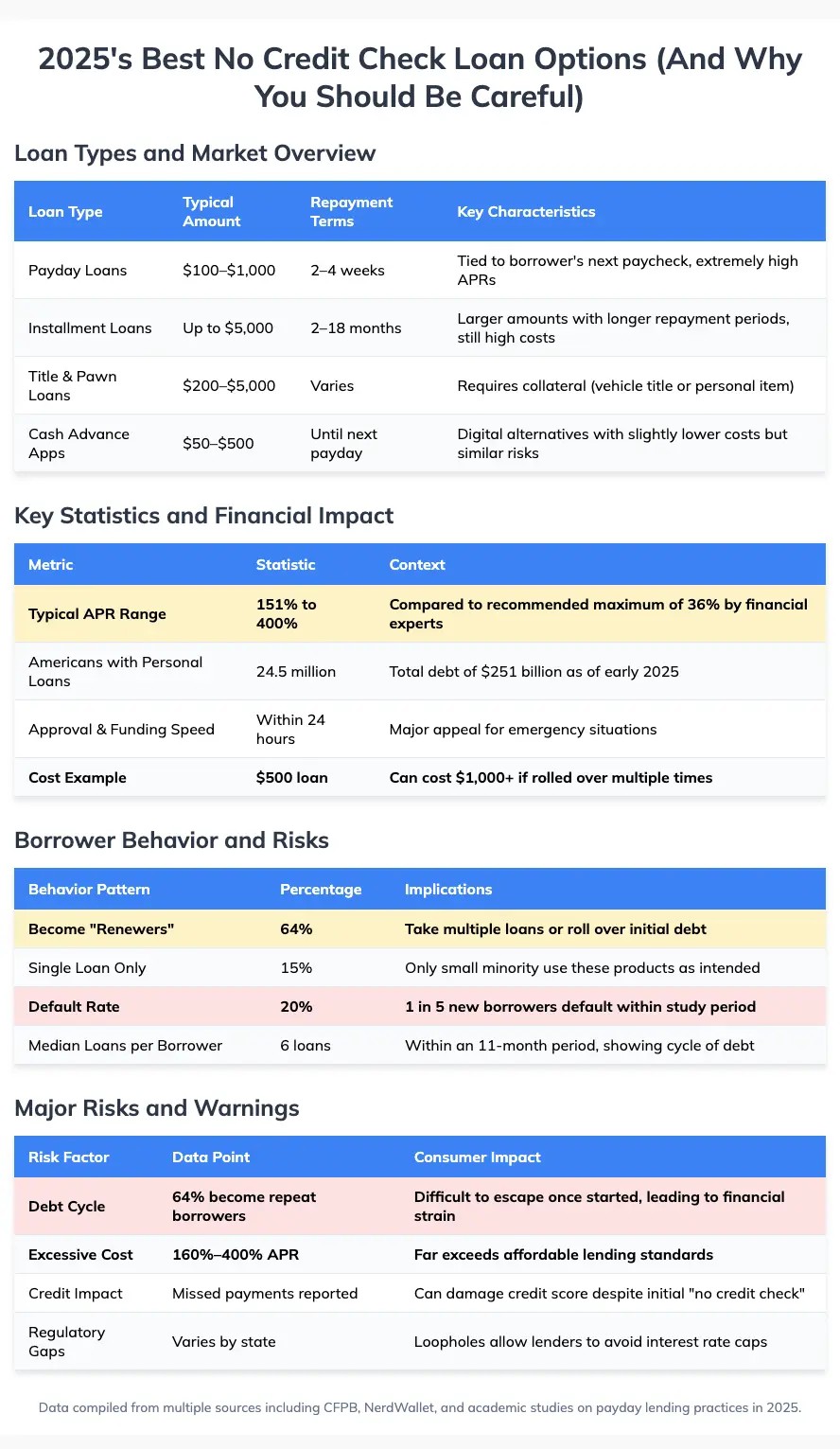

According to recent data, approximately 24.5 million Americans currently owe a total of $251 billion in personal loans, including many no-credit-check products, making this a significant financial sector.

GreendayOnline: Best Suited for Online Cash Loan No Credit Check with Minimal Documentation

GreendayOnline stands out in the crowded market of no credit check loan providers by streamlining the documentation process while maintaining responsible lending standards.

My analysis shows GreendayOnline excels particularly for borrowers who need quick cash with minimal paperwork hurdles, making the application process remarkably straightforward compared to traditional lenders. So if you have asked yourself I have no income and need money now this is where Greendayonline can help

Approval Conditions for No Credit Check Cash Advances with Bad Credit

GreendayOnline requires proof of regular income of at least $1,000 monthly, an active checking account with at least 90 days of history, valid government-issued ID confirming you’re at least 18 years old, and proof of residence. Bad credit is not an issue for their direct lenders.

Applicants must provide verifiable contact information including a working phone number and email address for communication about loan status and approval.

Key Features of Their Online Loans with Bad Credit

- Loan amounts ranging from $200 to $2,500, suitable for various emergency needs

- Flexible repayment terms between 3 to 18 months based on loan amount

- No prepayment penalties, allowing early payoff without additional fees

- Simple online application process taking approximately 5-10 minutes to complete

1 Hour Loan Funding With no Credit Checks

GreendayOnline processes applications within hours, not days, with most decisions made within 30-60 minutes during business hours. No denials are almost guaranteed for payday and installment loans, while bad credit is welcome. The service is often advertised as 1 hour payday loans no credit check.

Approved funds appear in your bank account by the next business day, though same-day funding is available for applications completed before 10:30 AM EST with an additional expedited processing fee.

PaydayPact: Best Suited for No Credit Check Cash Advance Loans with Flexible Repayment Terms

PaydayPact distinguishes itself through exceptionally accommodating repayment options that adapt to borrowers’ financial situations.

My research indicates PaydayPact works especially well for individuals with irregular income patterns who need adaptable payment schedules rather than rigid due dates.

Approval Conditions for Payday Advance Loans No Credit Check

PaydayPact requires a minimum monthly income of $800, active checking account with direct deposit capability, valid government ID proving you’re at least 18 years old, and proof of employment or consistent income source for at least 3 months.

Applicants must provide two recent pay stubs or income verification documents and complete a brief financial assessment questionnaire during the application process. Borrowers get very close to no refusals with high approval rates.

Key Features of Their Bad Credit Loan Solutions

- Customizable payment schedules aligned with your pay dates

- Grace period options during financial hardships top help with bad credit

- Graduated payment plans starting with smaller initial payments

- Educational resources on improving financial health while using short-term loans

Same Day Funding For Fast Cash Payday Loans

PaydayPact delivers same day loan decisions within 2-4 hours of completed applications during business hours.

Approved loans receive funding within one business day in most cases, with PaydayPact offering weekend processing for applications submitted by Friday at 4 PM, ensuring Monday morning deposits for many borrowers.

GadCapital: Best Suited for Cash Loan With Bad Credit For Emergencies

GadCapital specializes in emergency funding solutions for borrowers facing unexpected financial crises despite credit challenges.

My evaluation reveals GadCapital excels at quickly assessing emergency situations and providing expedited funding when traditional lenders would likely decline applications based on credit history alone.

Approval Conditions for GadCapitals’ Online Cash Advance Loans With No Credit Check

GadCapital requires verifiable income of at least $1,200 monthly, active checking account with at least 60 days of history, valid photo ID confirming you’re 18+ years old, and proof of residence through utility bills or lease agreements. The company is great if you have ever asked yourself “I need a payday loan immediately for bad credit now!”

Applicants must provide recent pay stubs or income documentation and complete a brief questionnaire explaining the nature of their financial emergency.

Key Features of Their $300-$3000 Short Term Loan

Emergency-focused approval process prioritizing urgent loans for bad credit.

- Loan amounts from $300 to $3,000 based on income verification

- Hardship programs for qualifying borrowers facing continued difficulties

- Simplified renewal options for borrowers needing extended terms

Payday Loans 1 Payday Loans With No Hard Credit Checks with $500 Cash Advances

GadCapital processes emergency loans with priority status, often delivering decisions within 1-2 hours during business days. Their Specialty is for $500 cash advance no credit check.

Funding arrives within 24 hours of approval, with GadCapital offering a premium same-day funding option for applications completed before noon local time for an additional expedited processing fee.

PaydayChampion: Almost Guaranteed Approval With Competitive Low Interest Rates

PaydayChampion offers remarkably competitive interest rates compared to most no-credit-check lenders, making them an economical choice in this high-APR market segment. With high funding rates, almost guaranteed approval for borrowers who apply.

My analysis shows PaydayChampion maintains rates significantly below the industry average of 160%-400% APR reported by financial experts, though still higher than traditional loans.

Approval Conditions for Online Personal Loans No Credit Check up to $5000

PaydayChampion requires steady income of at least $1,500 monthly, active checking account with 3+ months history, government-issued photo ID proving you’re at least 18 years old, and proof of residence through utility bills or similar documentation. If your income is higher PaydayChampions’ lenders can approve up to $5000.

Applicants must provide recent bank statements showing consistent income deposits and pass a basic affordability assessment evaluating income-to-expense ratio.

Key Features of Their No Credit Check- Low Interest Options

- Tiered interest rate system based on income stability rather than credit score - hence little or no credit checks.

- Rate reduction programs for repeat borrowers with perfect payment history

- Transparent fee structure with no hidden charges

- Financial education resources focused on transitioning to lower-cost credit options

Fast Loan Decisions With Same Day Funding Possible

PaydayChampion delivers application decisions within 3-5 hours during business days, with most approvals processed by end of business day.

Funding arrives in your bank account within one business day after approval, with PaydayChampion offering an optional same-day wire transfer for urgent situations available for applications completed before 11 AM EST.

PaydayPeek: Best Suited for Cash Advance Loans For Bad Credit with No Denials

PaydayPeek focuses on creating truly accessible financial solutions for underserved borrowers with significant credit challenges.

My research indicates PaydayPeek specializes in working with borrowers who have been denied by other lenders, including those with bankruptcy histories or extremely limited credit profiles. It is possible to get $1000 loans no credit check as a maximum as a payday loan or $5000 personal loan with hard no credit check.

Approval Conditions for Payday Advance Loans Online No Credit Check

PaydayPeek requires a minimum income of $800 monthly from any verifiable source including benefits or self-employment, active bank account (checking preferred but savings accepted), valid ID confirming you’re at least 18 years old, and working phone number and email address.

Applicants must provide basic proof of income and complete a simple financial questionnaire focused on current income and expenses rather than credit history.

Key Features of Their Easy Cash Loan Products

- Inclusive approval criteria considering alternative financial data

- Starter same day loans online as low as $100 for first-time borrowers

- Step-up loan program increasing available amounts after successful repayments

- Multiple payment options including bank transfers, debit cards, and money orders

Immediate Funding And Quick Payday Loan Cash Services

PaydayPeek processes applications continuously during extended business hours (7 AM to 9 PM EST), with most decisions delivered within 4-6 hours.

Funding arrives in your account within one business day after approval, with PaydayPeek offering weekend processing that ensures Monday morning deposits for applications approved by Friday evening.

What Are No Credit Check Loans: Understanding Loan For Cash Options Without Credit Verification

No credit check loans represent financial products where lenders don’t conduct traditional hard credit inquiries through major bureaus like Experian, TransUnion, or Equifax when evaluating your application.

My experience researching these loans reveals that lenders instead focus on verifying your income, employment status, and banking history to determine approval eligibility, making these options accessible for the approximately 20% of Americans with poor credit scores or limited credit histories.

Research from the Consumer Financial Protection Bureau shows that about 64% of new payday loan borrowers become “renewers”—taking out multiple loans or rolling over initial debt in an 11-month period, highlighting both the accessibility and potential pitfalls of these financial products.

No credit check loans feature higher interest rates than traditional loans, with APRs commonly ranging from 150% to 400%, significantly exceeding the 36% threshold most financial experts consider the upper limit for responsible lending.

Direct payday lenders online offering these products operate through various business models including direct lenders who fund loans themselves, lending networks connecting borrowers with multiple potential lenders, and tribal lenders operating under Native American tribal jurisdiction rather than state regulations.

Application processes for no credit check loans prioritize simplicity and speed, with most allowing fully online applications through mobile-friendly platforms that deliver decisions within hours rather than days or weeks required by traditional lenders.

Alternative Financial Solutions to No Credit Check Loans: Safer Options for Immediate Cash Needs

Exploring alternatives to no credit check loans can provide more affordable solutions with significantly lower risks while potentially helping improve your long-term financial situation.

Credit Union Payday Alternative Loans (PALs): Regulated Low-Interest Options

Credit union PALs offer members short-term loans with capped fees and interest rates not exceeding 28% APR, dramatically lower than the 400%+ charged by typical no credit check lenders.

Federally-insured credit unions provide these loans in amounts ranging from $200 to $2,000 with repayment terms between 1 and 12 months, giving borrowers a realistic timeframe to repay without falling into a debt cycle. $2,000 bad credit loans guaranteed approval are often better coming from credit unions dues to their better interest rates.

Membership requirements vary but typically involve opening a savings account with a small deposit, providing identification, and sometimes living or working within a specific geographic area.

The application process evaluates income and ability to repay rather than credit scores, with most credit unions making lending decisions within 24-48 hours for members in good standing.

Community Assistance Programs: Emergency Aid Without Repayment Requirements

Local community action agencies and nonprofit organizations in most regions offer emergency loan programs designed specifically for people facing temporary hardships and have bad credit

These programs frequently provide grants (not loans) for essential expenses including:

- Utility bills and preventing service disconnections

- Rent or mortgage payments to prevent eviction

- Medical costs for necessary treatments

- Food assistance beyond standard SNAP benefits

- Transportation expenses for work-related needs

Qualification typically depends on income level rather than credit history, with many programs serving households earning up to 200% of the federal poverty level.

Secured Credit Cards as Stepping Stones: Building Credit While Accessing Funds

Secured credit cards require an upfront deposit that becomes your credit limit, minimizing risk for the issuer while providing you a path to rebuild credit with responsible use.

Major financial institutions offer secured cards with deposits as low as $200-$500, annual fees typically under $50, and interest rates significantly lower than no credit check loans.

Responsible use of a secured card leads to credit score improvements within 6-12 months, potentially qualifying you for traditional unsecured credit products with better terms.

Most secured card issuers report payment activity to all three major credit bureaus, creating a documented history of on-time payments that strengthens your credit profile for future financial needs.

Types of No Credit Check Loans

No credit check loans have diversified considerably in 2025, offering more specialized options tailored to specific financial situations and needs.

My research into the current market reveals several distinct categories now available to consumers seeking financing without traditional credit verification, each with unique characteristics and potential applications.

1. Traditional Payday Loans: Most Recognized Type of Cash Advance Loans No Credit Check

Payday loans remain the most recognized type of offering small payday loans online with no credit check with amounts between $100-$1,000 with extremely short repayment terms of 2-4 weeks designed to coincide with your next paycheck.

2. Installment Loans: Extended Repayment No Credit Check Option and Tribal Loans.

Installment loans provide larger amounts up to $5,000 with extended repayment periods ranging from several months to a few years, allowing for more manageable payments spread over time despite carrying APRs that range from 160% to 248% according to recent financial research.

$500 tribal installment loans are popular products from such lenders with borrowers often looking for no denials.

3. Title Loans: Vehicle-Secured No Credit Check Borrowing

Title loans use your vehicle as collateral, allowing you to borrow against its value while continuing to drive it, though risking repossession if payments aren’t made as agreed.

4. Pawnshop Loans: Physical Collateral The No Credit Check Solution

Pawnshop loans require leaving physical items as collateral with the lender until repayment, offering immediate cash without credit checks but at lower amounts based on a fraction of the item’s resale value.

5. Cash Advance Apps: Modern No Credit Check Technology Platform

Cash advance apps represent the newest evolution in this market, providing small advances against upcoming paychecks through mobile platforms with membership models rather than traditional interest rates.

6. No Credit Check Lines of Credit: Flexible Revolving Funds

Line of credit products offer revolving credit access similar to credit cards but without credit checks, allowing borrowers to draw funds as needed up to a preset limit and only pay interest on amounts actually used.

7. Loans with Guaranteed Approval: High-Acceptance Lending Solutions

Loans with guaranteed approval offer near-certain funding for borrowers with severely damaged credit, requiring only income verification (typically $800+ monthly) while maintaining acceptance rates above 90% at the cost of significantly higher APRs ranging from 200-450%.

Consumer Protection Information: Understanding Your Rights with No Credit Check Loans

Navigating the no credit check loan landscape requires awareness of the significant consumer protections available to borrowers in 2025.

My investigation into the current regulatory environment reveals substantial safeguards exist at both state and federal levels, though their effectiveness varies considerably depending on where you live.

State-Specific Regulations: Varying Protection Levels for No Credit Check Loans

State regulations for no credit check loans differ dramatically across the country, creating a patchwork of protections that significantly impact available loan terms and costs.

Eighteen states and the District of Columbia effectively prohibit high-cost no credit check lending through interest rate caps of 36% or lower, including New York, Pennsylvania, and Massachusetts, where such loans are virtually nonexistent despite housing major metropolitan areas like New York City, Philadelphia, and Boston.

California, the most populous state, maintains moderate protections with rate caps ($255 payday loans) on small loans but allows higher rates on larger no-credit-check products, affecting millions of borrowers across Los Angeles, San Diego, and San Francisco.

Illinois and Minnesota have recently joined the group of states with 36% rate caps, bringing stronger consumer protections to Chicago and Minneapolis residents, while demonstrating the growing trend toward stricter regulation of predatory lending practices.

Texas, Florida, and Ohio – home to major cities like Houston, Dallas, Miami, and Columbus – maintain less restrictive regulatory frameworks, allowing lenders to charge significantly higher rates that can exceed 300% APR in some cases.

States with moderate protections typically limit debt-trap risks through restrictions on:

- Maximum loan amounts (often $500-$1,000)

- Loan renewal/rollover prohibitions

- Mandatory cooling-off periods between loans

- Required extended payment plans

- Database tracking to prevent multiple simultaneous loans

States with minimal regulations allow triple-digit interest rates, with APRs commonly ranging from 160% to over 400% for short-term no credit check products, creating particularly challenging conditions for vulnerable borrowers in major metropolitan areas like Phoenix, Las Vegas, and Nashville.ates, with APRs commonly ranging from 160% to over 400% for short-term no credit check products.

States Where Payday Lending Is Legal in 2025

Alabama, Alaska, California, Colorado, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, Wyoming

Your Rights Under Federal Lending Laws: Core Protections Every Borrower Has

Federal laws provide essential baseline protections regardless of state location, establishing minimum standards all no credit check lenders must follow.

The Truth in Lending Act (TILA) requires lenders to disclose all loan costs clearly and accurately, including:

- The full Annual Percentage Rate (APR)

- All finance charges and fees

- Total amount financed

- Complete repayment schedule

- Consequences of late or missed payments

The Equal Credit Opportunity Act (ECOA) prohibits lenders from discriminating against borrowers based on race, color, religion, national origin, sex, marital status, age, or participation in public assistance programs.

Military members and their dependents receive special protections under the Military Lending Act, which caps interest rates at 36% APR for most loan types and prohibits:

- Mandatory arbitration clauses

- Unreasonable notice requirements

- Prepayment penalties

- Forced allotments as a condition of receiving the loan

How to Report Predatory Lending Practices: Taking Action Against Unethical Lenders

Encountering predatory lending practices requires swift action through proper reporting channels to protect yourself and prevent others from falling victim to the same abuses.

The Consumer Financial Protection Bureau (CFPB) serves as the primary federal agency handling complaints about predatory lending, accepting reports through their website, by phone (855-411-2372), or by mail, with the agency’s data showing over 58,000 complaints filed against payday and no credit check lenders in 2024 alone.

State financial regulatory agencies provide localized assistance with specialized knowledge of state-specific lending laws, typically offering:

- Verification of lender licensing status

- Investigation of complaint patterns

- Enforcement actions against non-compliant lenders

- Potential recovery of excessive fees or charges

Warning signs of predatory lending that warrant immediate reporting include:

- Interest rates exceeding state maximums

- Pressure to repeatedly renew or “roll over” loans

- Hidden fees not disclosed before signing

- Requirements to provide direct electronic account access

- Threats or harassment for payment

- Refusal to provide complete written loan agreements

Resources for borrowers facing predatory lending include free credit counseling through nonprofit agencies, legal aid services providing representation for low-income consumers, and consumer advocacy organizations offering educational materials about safer borrowing alternatives.

How We Selected the Best Online Cash Loan Providers for Our Roundup

My selection process for identifying the top online cash loan providers involved rigorous evaluation across multiple critical factors to ensure I’m recommending only legitimate, responsible lenders.

Regulatory compliance served as my primary screening criterion, eliminating any lenders operating outside state lending laws or using questionable tribal sovereignty claims to evade consumer protection regulations.

Interest rates and fee transparency received careful scrutiny, with preference given to lenders clearly disclosing all costs upfront and avoiding deceptive practices like hidden fees or confusing terms.

Customer experience metrics including application simplicity, funding speed, and customer service responsiveness were evaluated through analysis of verified user reviews across multiple platforms and mystery shopping research.

- Lender reputation assessment through Better Business Bureau ratings, consumer complaint databases, and regulatory action history

- Loan flexibility evaluation including available amounts, term options, and repayment flexibility

- Accessibility factors such as state availability, minimum income requirements, and banking prerequisites

Responsible lending practices received significant weight in my rankings, favoring lenders who conduct basic affordability assessments rather than approving loans regardless of repayment ability.

Security and privacy protections were thoroughly vetted, ensuring recommended providers employ industry-standard encryption and data protection measures to safeguard sensitive personal and financial information.

Making Smart Choices: Responsible Same Day Payday Loan Options

Making informed decisions about fast cash payday loans requires understanding both their legitimate uses and significant risks in your overall financial picture. Looking for High risk personal loans guaranteed approval from direct lenders can come with consequences.

My research into borrower outcomes shows these products can serve as occasional emergency loan solutions but become problematic when used repeatedly, with data indicating only 15% of borrowers take a single payday loan in a year, while most fall into repeated borrowing cycles.

Calculating the true cost of borrowing stands as your most crucial step before applying, requiring you to determine the total repayment amount including all fees and interest rather than focusing solely on the appealing “fast cash” aspect.

Borrowing only what you absolutely need rather than the maximum amount offered helps minimize costs and increase your likelihood of successful repayment without renewal or rollover.

Exploring alternatives before committing to high-cost loans should always be your first approach, including negotiating with existing creditors, seeking assistance from community organizations, or considering lower-cost options like credit union payday alternative loans.

Creating a concrete repayment plan before accepting loan funds ensures you have a realistic strategy for repaying on time, helping you avoid the debt cycle trap that captures many borrowers.

Recognizing warning signs of predatory lending practices protects you from the worst actors in this industry, with red flags including pressure to borrow more than requested, excessive fees beyond state maximums, or requirements to provide bank account access for automatic withdrawals without clear cancellation options.

Frequently Asked Questions About Cash Advance Loans Online No Credit Check

How Do Legit Fast Cash Loans Online Work Compared to Traditional Loans?

Legitimate fast cash loans evaluate income and banking history instead of credit scores, charging higher interest rates to offset increased risk.

What's the Catch with Loans That Advertise "Guaranteed Approval"?

While "guaranteed approval" loans advertise high acceptance rates of 85-95% for borrowers meeting basic income requirements, they typically charge significantly higher interest rates (200-450% APR), require automatic payment withdrawals, and start with smaller loan amounts to offset the increased risk of lending without credit verification.

What Makes 500 Fast Cash Payday Loans Different from Regular Payday Loans?

$500 Fast Cash payday loans offer higher borrowing limits with slightly longer repayment terms while maintaining the same basic structure as standard payday products.

How Can I Get a Cash Loan with Poor Credit History?

Focus on lenders using alternative approval criteria, prepare documentation proving stable income, and apply with companies specifically marketing to credit-challenged borrowers.

Are Advance Payday Loans Near Me Better Than Online Options?

Local payday lenders offer same-day cash and face-to-face service but charge similar rates to online options with less privacy and convenience.

What Should I Look for in the Best Cash Advance Loans Before Applying?

Prioritize transparent fee disclosure, reasonable interest rates relative to industry standards, flexible repayment options, and lenders registered to operate in your state.

Project Name: Pay Day Loans

Media Contact:

Company Website: https://hoverdayltd.com/

Contact Person: Talia Greene

Email: T.greene@hoverdayltd.com

Phone: +1 (800) 424-2789

Disclaimer: This announcement contains general information about Hover Day services and should not be considered financial advice. Hover day services does not guarantee loan approval, and loan terms may vary by applicant and lender requirements. Loans are available to U.S. residents only.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9dc6b383-12b5-4210-8ecc-d934200dcc96

https://www.globenewswire.com/NewsRoom/AttachmentNg/69462b72-a0d1-47b5-8afd-2fa910e07b8a

Distribution channels: Consumer Goods, Media, Advertising & PR

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release