AI in Trading Market is Poised for Significant Growth, Expected to Reach USD 50.4 billion by 2033

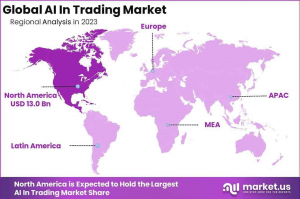

In 2023, North America held over 40.9% market share, driven by advanced technological infrastructure and, high concentration of AI technology firms...

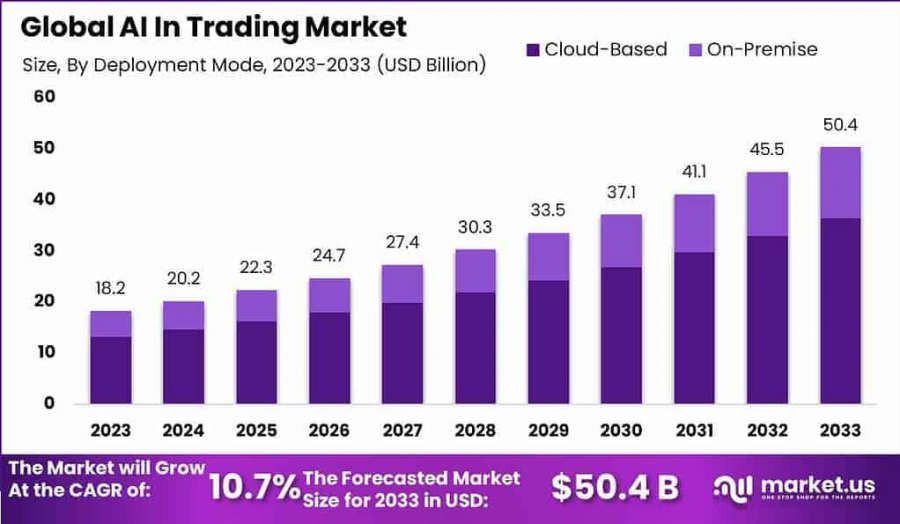

NEW YORK, NY, UNITED STATES, February 19, 2025 /EINPresswire.com/ -- The Global AI in Trading Market is poised for significant growth, expected to reach USD 50.4 billion by 2033, up from USD 18.2 billion in 2023, with a compound annual growth rate (CAGR) of 10.7% over the forecast period from 2024 to 2033. AI in trading leverages technologies such as machine learning and natural language processing to analyze market data, execute trades, and optimize trading strategies automatically, enhancing efficiency and precision in the financial markets.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=118923

Key Takeaways

Increasing Adoption: The AI in the trading market has seen robust growth due to the widespread adoption of algorithmic trading and advancements in big data analytics. Hedge funds, investment banks, and asset management firms extensively use AI tools to improve trading efficiency, risk management, and portfolio optimization.

Technological Integration: Key factors driving market expansion include advancements in AI technologies, a vast amount of available financial data, and the demand for sophisticated trading strategies. The integration of machine learning has allowed market players to analyze extensive data sets rapidly, which is crucial for real-time trading decisions.

Investment Growth: The investment landscape for AI-powered trading platforms shows substantial growth, with investments reaching ~$3.5 billion in 2023, marking a 40% increase from the previous year. This growth underscores the strategic importance of AI technologies in financial services.

North America's Dominance: In 2023, North America captured over 40.9% of the market share due to advanced technological infrastructure and a high concentration of AI firms. The region's supportive regulatory environment and significant investments in AI R&D further bolster its market dominance.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/ai-in-trading-market/free-sample/

Deployment Mode Analysis

Cloud-Based Solutions: In 2023, cloud-based solutions led the market with over 72.5% share. The flexibility, scalability, and cost-effectiveness of cloud platforms make them popular among financial institutions, as they eliminate the need for extensive on-site infrastructure and facilitate rapid updates of AI algorithms.

Application Analysis

Algorithmic Trading: This segment dominated the market, holding over 37.1% share, reflecting the efficiency and speed offered by AI systems in executing large volumes of transactions. This reduces human errors and enhances profitability through strategic decision-making and data analysis capabilities.

Key Market Segments

By Deployment Mode

Cloud-Based

On-Premise

By Application

Algorithmic Trading

Risk Management

Portfolio Optimization

Sentiment Analysis

Other Applications

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=118923

Drivers and Restraints

Key Driver: Technological advancements in AI, like improved algorithmic efficiency and sophisticated machine learning models, play a crucial role in driving the AI in trading market. These technologies allow more precise analysis and quicker processing of data, essential for maintaining a competitive edge.

Major Restraint: The high costs of implementing AI solutions pose a barrier, especially for smaller firms. The investment required for hardware, software, and skilled personnel makes it challenging for some companies to adopt AI-driven trading solutions, limiting market growth.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/ai-in-trading-market/free-sample/

Opportunities and Challenges

Opportunities: There is a growing demand for personalized trading solutions, as sophisticated investors desire customized strategies that align with their risk tolerances. AI's ability to provide tailored trading recommendations based on personal data enhances investor satisfaction and opens new market segments.

Challenges: Data privacy and security concerns are significant, as AI trading systems need access to sensitive financial data. Ensuring data protection against breaches is critical, especially with increasing regulatory scrutiny around data privacy.

Emerging Trends

Generative AI and Cloud Integration: The integration of AI into cloud services and the use of generative AI in business functions, including trading, are notable trends. These advancements enhance algorithm precision and provide new opportunities for product development and optimization within financial markets.

Key Players

Prominent players in the AI trading market include AlphaSense, NVIDIA Corporation, OpenAI, Amazon Web Services, Hudson Labs, and more. These companies lead the charge in the innovation and application of AI in trading, offering solutions that automate and optimize trading processes, providing traders with competitive advantages.

Recent Developments

In September 2023, AlphaSense raised ~$150 million in a Series E funding round to enhance its generative AI capabilities for enterprise customers. Additionally, NVIDIA announced new AI innovations at CES in January 2024, focusing on enhancing AI applications across sectors, including finance and trading.

Conclusion

The AI in trading market is on an upward trajectory, driven by technological advancements and increasing investments. While challenges such as implementation costs and data security remain, the market presents significant opportunities for growth, particularly in personalized trading solutions and integration of AI technologies. The strategic application of AI continues to shape the future of trading, offering financial institutions enhanced capabilities and efficiencies.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Banking Process Automation Market - https://market.us/report/banking-process-automation-market/

Child Care Management Software Market - https://market.us/report/child-care-management-software-market/

Stock Trading and Investing Applications Market - https://market.us/report/stock-trading-and-investing-applications-market/

Digital Asset Management (DAM) Software Market - https://market.us/report/digital-asset-management-dam-software-market/

Food 3D Printing Market - https://market.us/report/food-3d-printing-market/

Virtual Content Creation Market - https://market.us/report/virtual-content-creation-market/

AI in Food Processing Market - https://market.us/report/ai-in-food-processing-market/

Wireless Bluetooth Speaker Market - https://market.us/report/global-wireless-bluetooth-speaker-market/

Dark Web Intelligence Market - https://market.us/report/dark-web-intelligence-market/

Volumetric Soil Moisture Sensor Market - https://market.us/report/volumetric-soil-moisture-sensor-market/

Remote Workplace Services Market - https://market.us/report/remote-workplace-services-market/

Voice and Language Intelligence Market - https://market.us/report/voice-and-language-intelligence-market/

Motion Control Software in Robotics Market - https://market.us/report/motion-control-software-in-robotics-market/

Online Project Management Software Market - https://market.us/report/online-project-management-software-market/

Yield Monitoring System Market - https://market.us/report/yield-monitoring-system-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release