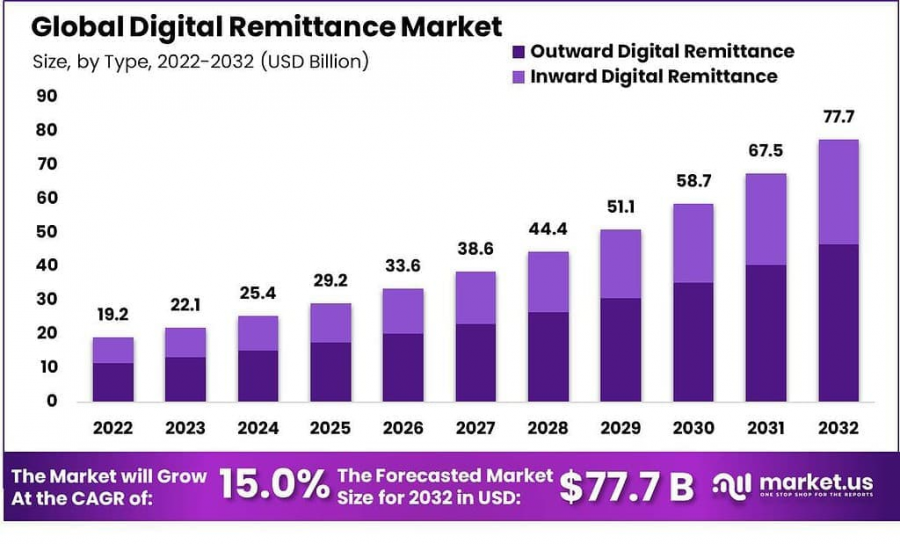

Digital Remittance Market Expected to Achieve a Valuation of USD 77.7 Billion by 2032

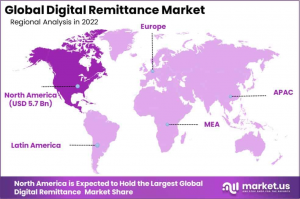

Regional Analysis: North America leads the market, with a significant revenue share of 30.2%, followed by the Asia Pacific region...

NEW YORK, NY, UNITED STATES, February 19, 2025 /EINPresswire.com/ -- The Digital Remittance Market is witnessing robust growth, expected to achieve a valuation of USD 77.7 billion by 2032, rising from USD 22.1 billion in 2023. This market is expanding at a strong CAGR of 15.0% driven by advanced mobile-based solutions.

Digital remittance involves the electronic transfer of funds across borders, offering a fast and cost-effective alternative to traditional methods. It is a rapidly evolving sector, characterized by strong competition among established financial entities and fintech startups.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=12200

The growing global diaspora, coupled with increased international migration, fuels the demand for efficient cross-border transactions. Innovations in technology, regulatory support for financial inclusion, and the proliferation of smartphones are key to transforming this market, offering users enhanced security and convenience. As these trends continue, staying abreast of market dynamics, regulatory changes, and consumer preferences becomes crucial for stakeholders.

The digital remittance market is projected to grow at a robust compound annual growth rate (CAGR) of 15.0%, reaching an estimated value of USD 77.7 billion by 2032, up from USD 22.1 billion in 2023. The outward digital remittance segment accounted for over 60% of the market share, fueled by globalization trends and the increasing demand for seamless cross-border transactions. In 2022, Money Transfer Operators (MTOs) held a dominant position in the market with over 39.8% of the share, as their established trust and technological advancements have made them the preferred providers of remittance services.

The personal remittance segment also held a significant 58.4% share in 2023, driven by globalization, international employment, and tourism. North America currently leads the market with a notable revenue share of 30.2%, while the Asia Pacific region is expected to experience substantial growth in the coming years. Experts highlight that government incentives aimed at enhancing digital infrastructure and regulatory frameworks, along with technological innovations like blockchain and AI, are boosting transaction speed, security, and overall sector growth.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/digital-remittance-market/free-sample/

Experts Review

Investment Opportunities & Risks: High growth potential offers lucrative investment opportunities, but risks include regulatory compliance and technological adoption variability globally, which could affect profitability.

Consumer Awareness: As consumer awareness increases, individuals demand more efficient digital remittance services, prompting fintech companies to focus on user-friendly solutions implementing secure and transparent features.

Technological Impact: Rapid technological advancements in online platforms and mobile apps have significantly streamlined remittance processes, leading to increased participation and accessibility across various regions.

Regulatory Environment: The evolving regulatory landscape offers opportunities but requires careful navigation to ensure compliance while expanding services internationally, ensuring consumer protection and financial transparency.

Report Segmentation

The Digital Remittance Market is categorized by type, channel, and end-users to effectively capture its diversity and adaptability. Under type, the market is split into Outward and Inward Digital Remittance, focusing on cross-border and domestic transactions. Channel segmentation includes Money Transfer Operators (MTOs), Banks, Online Platforms, and other channels, each catering to specific consumer needs with varied service offerings.

End-users are segmented into Business and Personal, reflecting distinct usage patterns where businesses require large volume transfers, and individuals prioritize convenience and cost-effectiveness. The Outward Digital Remittance segment dominates due to globalization and demand for efficient cross-border transactions. Channel analysis shows MTOs as leaders, while end-user analysis highlights the Personal segment's growth due to increasing global mobility and digital savviness.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=12200

Key Market Segments

By Type

Outward Digital Remittance

Inward Digital Remittance

By Channel

Money Transfer Operators

Banks

Online Platforms

Other Channels

By End-User

Business

Personal

Drivers, Restraints, Challenges, and Opportunities

Drivers: The market is driven by globalization and the proliferation of digital technologies, enhancing the accessibility and speed of remittances. The widespread use of smartphones and mobile apps has made digital remittances more convenient and user-friendly.

Restraints: Challenges include limited technological infrastructure in developing regions, hindering digital financial services' accessibility. The digital divide presents a barrier to broader market adoption.

Challenges: Meeting regulatory requirements globally can be complex, presenting challenges in the seamless provision of digital remittance services. Security concerns and technological disparities also pose significant challenges.

Opportunities: Blockchain integration offers opportunities for increasing transparency, reducing transaction fees, and enhancing security, potentially redefining future remittance processes and expanding market reach.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/digital-remittance-market/free-sample/

Key Player Analysis

Leading companies like PayPal, Western Union, and MoneyGram play significant roles in the digital remittance arena. Western Union and MoneyGram have cultivated extensive global networks, establishing trust and reliability. PayPal innovates continuously, offering cost-effective solutions that challenge traditional services. These key players expand their services through strategic partnerships and technological investments to improve user experiences, ensuring leadership in the competitive digital remittance market landscape. Their dominance is maintained through leveraging technology to enhance service delivery and network expansion.

Top Key Players in the Digital Remittance Market

PayPal Holdings Inc.

Digital Wallet Corporation

InstaReM Pvt. Ltd.

MoneyGram

Azimo B.V.

TransferGo Ltd.

Western Union Holdings Inc.

Ria Money Transfer.

WorldRemit Ltd.

OFX

Other Key Players

Recent Developments

In January 2023, Xoom partnered with Visa Direct to expedite transfers, facilitating access to funds in 25 nations, including Thailand and Vietnam, showcasing collaboration for increased efficiency. In September 2022, Western Union acquired Te Enviei, enhancing its presence in Brazil and accelerating mobile payment services. These developments highlight ongoing efforts to improve digital remittance services' accessibility and convenience, expanding their reach globally and offering innovative financial solutions to meet users' evolving needs.

Conclusion

The Digital Remittance market is on a promising trajectory, driven by technological and regulatory advancements, and increasing consumer demand for efficient financial transactions. While challenges like infrastructure gaps persist, innovations in blockchain and collaborative ventures present significant growth opportunities, ensuring that digital remittance continues to redefine cross-border financial interactions. As the market evolves, stakeholders must focus on bridging technological disparities to maximize this sector's full potential in serving diverse global communities.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Smart Food Bin Market - https://market.us/report/smart-food-bin-market/

Internet of Behaviors Market - https://market.us/report/internet-of-behaviours-market/

Computing Power Market - https://market.us/report/computing-power-market/

Remote Proctoring Solutions Market - https://market.us/report/remote-proctoring-solutions-market/

Dynamic Light Assist Technology Market - https://market.us/report/dynamic-light-assist-technology-market/

AI Based Pest Management App Market - https://market.us/report/ai-based-pest-management-app-market/

Memory Modules and Solid State Drives Market - https://market.us/report/memory-modules-and-solid-state-drives-market/

Public Safety Solution for Smart City Market - https://market.us/report/public-safety-solution-for-smart-city-market/

Insurance IT Spending Market - https://market.us/report/insurance-it-spending-market/

Security Safes Market - https://market.us/report/security-safes-market/

Generative AI in Gaming Market - https://market.us/report/generative-ai-in-gaming-market/

Generative AI in marketing Market - https://market.us/report/generative-ai-in-marketing-market/

Datafication Market - https://market.us/report/datafication-market/

Real-Time Kinematic Machine Market - https://market.us/report/real-time-kinematic-machine-market/

Development to Operations (DevOps) Market - https://market.us/report/development-to-operations-devops-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release