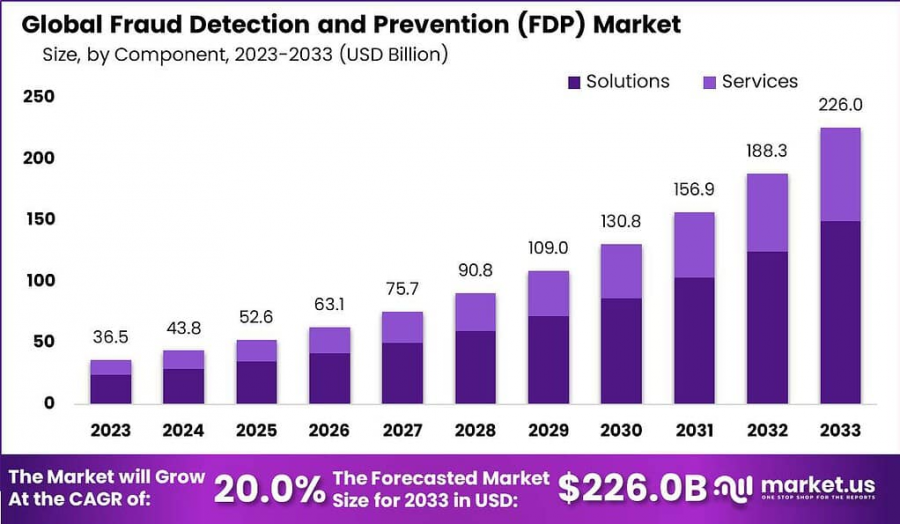

Fraud Detection and Prevention Market Expected to be Worth Around USD 226.0 Billion by 2033, With CAGR 20.0%

In 2023, North America held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 43.1% share...

NEW YORK, NY, UNITED STATES, January 28, 2025 /EINPresswire.com/ -- The Global Fraud Detection and Prevention (FDP) Market is anticipated to reach USD 226.0 billion by 2033, increasing from USD 36.5 billion in 2023, reflecting a CAGR of 20.0% from 2024 to 2033. This growth is propelled by the escalating frequency of fraudulent activities across various sectors, driven by the surge in digital transactions and the adoption of digital payment systems.

FDP has become crucial for businesses to safeguard financial transactions, and customer data, and maintain brand integrity. Key technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), have significantly enhanced fraud detection capabilities, enabling real-time anomaly detection and pattern identification.

🔴 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/fraud-detection-and-prevention-fdp-market/request-sample/

With the rise in e-commerce and online banking, coupled with stringent government regulations designed to protect consumer data, the demand for robust FDP solutions has increased. However, the market faces challenges such as high costs of implementing advanced systems and integration difficulties within existing IT frameworks, particularly for small and medium-sized enterprises (SMEs).

Key Takeaways

The FDP market is expected to be worth USD 226.0 billion by 2033, growing at a CAGR of 20.0% from 2024 to 2033.

In 2023, the Solutions segment held over 66.1% market share.

The Payment Fraud application accounted for more than 47.5% of the market.

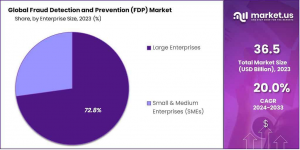

Large enterprises dominated with over 72.8% market share.

North America maintained a leading position with a 43.1% market share.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=67821

Experts Review

Experts assert that government incentives and technological innovations are vital for driving the FDP market. Government regulations mandating stringent data protection measures enhance market growth by requiring institutions to integrate advanced FDP systems. Innovations in AI and ML significantly contribute to these systems, allowing them to process large datasets rapidly and effectively, identifying complex fraud patterns.

Although there are substantial investment opportunities, risks include technological obsolescence and compliance challenges with evolving regulatory landscapes. Consumer awareness about fraud risks is increasing, leading businesses to prioritize robust prevention measures, thus fueling market demand.

The technological impact is profound, as innovations simplify the detection of sophisticated fraud schemes, thereby improving operational efficiency and security. Regulatory environments are evolving, demanding compliance with standards like PCI DSS, which fosters further deployment of advanced FDP solutions.

Despite these advancements, costs, and resource constraints for small businesses remain significant challenges, suggesting that future innovations focusing on cost-effectiveness and integration will be pivotal for market expansion.

🔴 𝐕𝐢𝐞𝐰 𝐏𝐃𝐅 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐒𝐚𝐦𝐩𝐥𝐞 @ https://market.us/report/fraud-detection-and-prevention-fdp-market/request-sample/

Report Segmentation

The Fraud Detection and Prevention Market is segmented by component, application, enterprise size, and end-use industry. By component, the market includes Solutions and Services. The Solutions segment, encompassing fraud analytics, governance, risk and compliance (GRC), and authentication systems, dominates, holding over 66.1% market share due to the necessity for comprehensive fraud prevention measures.

In applications, the market is led by the Payment Fraud segment, capturing more than 47.5% share owing to increased digital transactions and corresponding fraud. By enterprise size, Large Enterprises dominate with over 72.8% share, attributed to their resources for advanced FDP system integration needed to manage complex operations and comply with stringent regulations.

The end-use industry is led by the Banking, Financial Services, and Insurance (BFSI) sector, which accounts for over 27.6% of the market. This sector prioritizes FDP integration due to the high volume and sensitivity of financial transactions, with technological advancements and regulatory compliance driving their adoption of sophisticated fraud detection systems.

Key Market Segments

By Component

--Solutions

-----Fraud Analytics

-----Governance, Risk, and Compliance

-----Authentication

--Services

-----Managed Services

-----Professional Services

By Application

Payment Fraud

Money Laundering

Identity Theft

Other Applications

By Enterprise Size

Large Enterprises

Small & Medium Enterprises (SMEs)

By End-Use Industry

IT & Telecommunications

BFSI

Healthcare

Retail & E-commerce

Manufacturing

Government

Other End-Use Industries

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=67821

Drivers, Restraints, Challenges, and Opportunities

The flourishing NLP market is propelled by the adoption of AI technologies and the proliferation of IoT devices, driving the need for advanced fraud detection systems. This technological evolution provides opportunities for real-time data analysis and anomaly detection, essential in mitigating cyber threats. However, the increasing complexity of fraud techniques poses a significant restraint.

Cybercriminals continuously innovate, employing sophisticated methods that require advanced countermeasures, often costly and resource-intensive for businesses, particularly SMEs. Additionally, there is a severe shortage of skilled security professionals capable of optimizing these technologies for effective defense, presenting a formidable challenge.

Despite these hurdles, opportunities abound, particularly with the integration of AI, ML, and blockchain technologies that enhance the precision and effectiveness of fraud detection capabilities.

These technologies enable robust data analytics, facilitating proactive identification of fraud patterns. Furthermore, compliance with evolving regulatory frameworks provides additional market opportunities, as organizations seek comprehensive solutions that ensure security while meeting legal requirements, thereby augmenting their defense mechanisms in the dynamic digital landscape.

Key Player Analysis

The FDP market is shaped by key players like IBM Corporation, SAP SE, SAS Institute Inc., Experian PLC, and FICO, which are pivotal in advancing fraud detection technologies. IBM leads with its AI-driven security solutions, incorporating anomaly detection and machine learning to preempt fraud. SAP SE focuses on comprehensive fraud management applications that integrate seamlessly with business operations, ensuring robust compliance.

SAS Institute Inc. specializes in advanced analytics and real-time fraud detection solutions, vital for large-scale transaction security. Experian PLC blends conventional data insights with AI models, enhancing fraud risk analysis. FICO's advanced scoring solutions stand out for their real-time detection capabilities.

Collectively, these companies drive innovation through strategic partnerships, continuous R&D, and expansive product portfolios, which help maintain their competitive edge in a rapidly evolving landscape. Their emphasis on cutting-edge technologies and comprehensive service offerings positions them as leaders in addressing complex fraud challenges globally.

Top Key Players

IBM Corporation

SAP SE

SAS Institute Inc.

Experian plc

FICO

Oracle Corporation

Software AG

LexisNexis

RSA Security LLC

Fiserv, Inc.

NICE Systems Ltd.

ACI Worldwide Inc.

Other Key Players

Recent Developments

In 2023, the FDP market saw significant advancements with the introduction of cutting-edge AI-driven solutions. IBM's launch of Cloud Pak for Security enhanced fraud detection via enhanced data analytics and machine learning, streamlining the identification of complex fraud patterns.

Similarly, Experian's new Fraud Score system integrates traditional data with AI, offering refined risk assessments across the transactional landscape, vastly improving detection accuracy. FICO also upgraded its Falcon X9 solution, which leverages advanced AI capabilities to enhance real-time fraud detection and response efforts.

These innovations are indicative of a robust trend toward integrating sophisticated technologies to fortify fraud prevention measures. Furthermore, regulatory changes continue to shape product offerings, with companies aligning their solutions to meet evolving compliance standards, such as GDPR and PCI DSS.

These developments underscore the market's commitment to enhancing security measures, ensuring regulatory compliance, and fostering consumer trust across all sectors impacted by fraud.

Conclusion

The Fraud Detection and Prevention market is set for robust growth, fueled by technological advancements, heightened regulatory requirements, and increased consumer awareness. While challenges such as high implementation costs and a scarcity of skilled professionals persist, opportunities for technological integration and expansion into new sectors are abundant.

Key players continue to innovate, employing AI and ML to enhance awareness and response capabilities. As digital transactions proliferate, FDP solutions will remain critical in safeguarding economic activities. Emphasizing cost-effective and adaptive systems will be essential to sustain growth and secure transactions in an increasingly digital world.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

P2P Rental Apps Market - https://market.us/report/p2p-rental-apps-market/

Mobile Fraud Detection Market - https://market.us/report/mobile-fraud-detection-market/

AI Companion App Market - https://market.us/report/ai-companion-app-market/

AI Girlfriend App Market - https://market.us/report/ai-girlfriend-app-market/

AI App Development Market - https://market.us/report/ai-app-development-market/

RAN Automation Market - https://market.us/report/ran-automation-market/

Optical Fiber Monitoring Market - https://market.us/report/optical-fiber-monitoring-market/

Secure Digital Memory Card Market - https://market.us/report/secure-digital-memory-card-market/

Network Management System Market - https://market.us/report/network-management-system-market/

Observability Tools and Platforms Market - https://market.us/report/observability-tools-and-platforms-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release