Enterprise File Synchronization and Sharing Market to Surge to USD 63.64 Billion by 2032

The EFSS market is set to grow rapidly, driven by increased IT spending, business automation, and the need for secure data sharing.

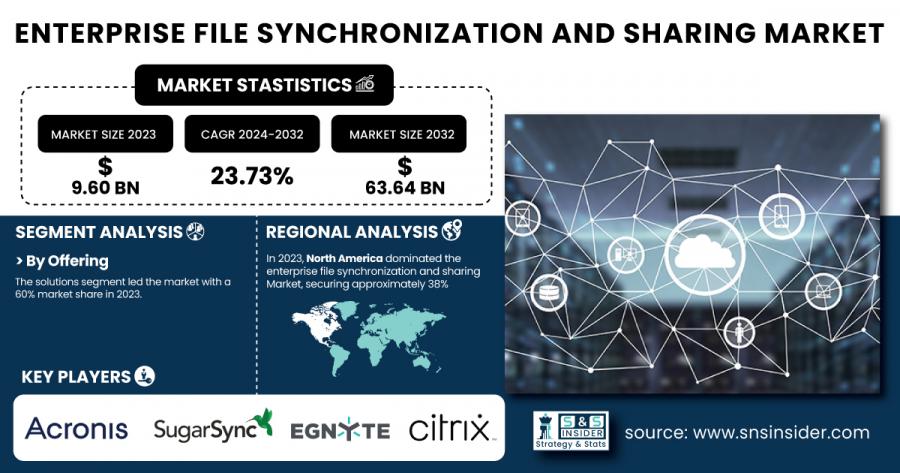

AUSTIN, TX, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The Enterprise File Synchronization and Sharing Market was valued at USD 9.60 Billion in 2023 and is projected to reach USD 63.64 Billion by 2032, growing at a compound annual growth rate (CAGR) of 23.73% from 2024 to 2032.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/3617

Keyplayers:

Acronis (Acronis Files, Acronis Cyber Protect Cloud)

SugarSync Inc. (SugarSync for Business, SugarSync Personal Cloud)

Egnyte Inc. (Egnyte Connect, Egnyte Protect)

Citrix Systems Inc. (Citrix ShareFile, Citrix Content Collaboration)

VMware Inc. (Workspace ONE, AirWatch)

Google LLC (Google Drive, Google Workspace)

Dropbox Inc. (Dropbox Business, Dropbox Advanced)

Thru (Thru Enterprise File Transfer, Thru Drive)

Syncplicity LLC (Syncplicity by Axway, SyncDrive)

Accellion Inc. (Kiteworks, Accellion File Transfer Appliance)

Box Inc. (Box Business, Box Enterprise)

Microsoft Corporation (OneDrive for Business, SharePoint)

BlackBerry Ltd. (BlackBerry Workspaces, BlackBerry UEM)

OpenText Corporation (OpenText Core Share, OpenText Hightail)

Intralinks (Intralinks VIA, Intralinks Dealspace)

Citrix Systems Inc. (Citrix Content Collaboration, ShareFile)

Tresorit (Tresorit Business, Tresorit Enterprise)

OwnCloud (OwnCloud Enterprise, OwnCloud Online)

Sync.com Inc. (Sync for Teams, Sync Business)

pCloud AG (pCloud for Business, pCloud Drive)

Growing Demand for EFSS Solutions: Enhancing Collaboration & Productivity

The Enterprise File Synchronization and Sharing market is thriving, fueled by rising IT expenditures and the need for effective and secure enterprise solutions. A large share of software projects (84.7%) targets enterprise applications, requiring secure EFSS solutions for smooth data transfer across platforms while maintaining compliance. Additionally, business automation efforts (53.6%) are propelling the demand for EFSS solutions that enhance workflows and efficiently handle data.

The need for smooth integration with current enterprise software ecosystems is driving the faster adoption of EFSS solutions. This integration improves workflow effectiveness and team productivity. Contemporary EFSS solutions extend beyond simple file sharing and storage, providing collaborative editing, version management, automatic backups, and AI-driven functionalities such as automatic tagging and improved search features. These characteristics grant employees immediate access to current information and enhance overall productivity.

Solutions Lead EFSS Market in 2023 with 60% Share, While Services Set for Rapid Growth Through 2032

In 2023, the solutions segment led the market, representing 60% of the total market share. These software options provide centralized oversight, teamwork tools, and strong security features such as encryption and adherence to compliance. Businesses favor them due to their scalability, user-friendliness, and smooth integration with other corporate systems, streamlining processes and improving collaboration.

The services segment is poised for the fastest growth during 2024-2032. The rise of cloud infrastructure and remote work has increased the demand for managed services. Companies like Accenture and IBM Global Services offer consulting, integration, and support services. These services help organizations select, implement, and maintain their EFSS solutions, ensuring ongoing optimization, security assessments, and compliance adherence

Cloud Dominates, On-Premises Segment Poised for Rapid Growth

Cloud solutions dominated the market in 2023, capturing 65% of the market share. Their key strengths lie in scalability, accessibility, and adaptability, enabling seamless file management and collaboration from any location with internet access. Popular cloud-based FSS platforms include Google Drive, Dropbox Business, and Microsoft OneDrive for Business, fostering remote and hybrid work environments.

The on-premises segment is poised for fastest growth from 2024 to 2032. This growth is primarily driven by the increasing demand for enhanced data management, security, and compliance within sectors like finance, healthcare, and government. On-premises solutions like Nextcloud and OwnCloud offer businesses greater control over file access, auditing, and data privacy by allowing them to store and manage data within their own secure data centers.

Enquiry Before Buy: https://www.snsinsider.com/enquiry/3617

North America Holds 38% of the EFSS Marke Share in 2023t, while Asia-Pacific is Projected to Experience the Fastest Growth

North America led the enterprise file synchronization and sharing market in 2023, holding a 38% market share. This dominance is attributed to high digital adoption and robust cloud infrastructure in the US and Canada. Key players like Microsoft and IBM, with offerings like OneDrive and FileNet, cater to the region's strong focus on cybersecurity and regulatory compliance.

The Asia-Pacific region is projected to exhibit the fastest growth in the EFSS market from 2024 to 2032. This growth is fueled by rapid digital transformation and increasing cloud adoption across countries like China, India, and Japan. Companies in APAC are increasingly adopting EFSS solutions to support remote workforces and enhance data sharing capabilities. Local players like Tencent and Zoho are contributing to this growth with innovative solutions tailored to the regional market.

Key Developments in Enterprise File Synchronization and Sharing Market

September 2024: Microsoft enhanced OneDrive for Business with new AI capabilities, including CoPilot integration, and improved collaboration features for educational and business users.

November 2023: VMware expanded its collaboration with Liquit to enhance its Enterprise App Repository (EAR) in Workspace ONE, improving application management for Windows devices.

Access Complete Report: https://www.snsinsider.com/reports/enterprise-file-synchronization-and-sharing-market-3617

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release