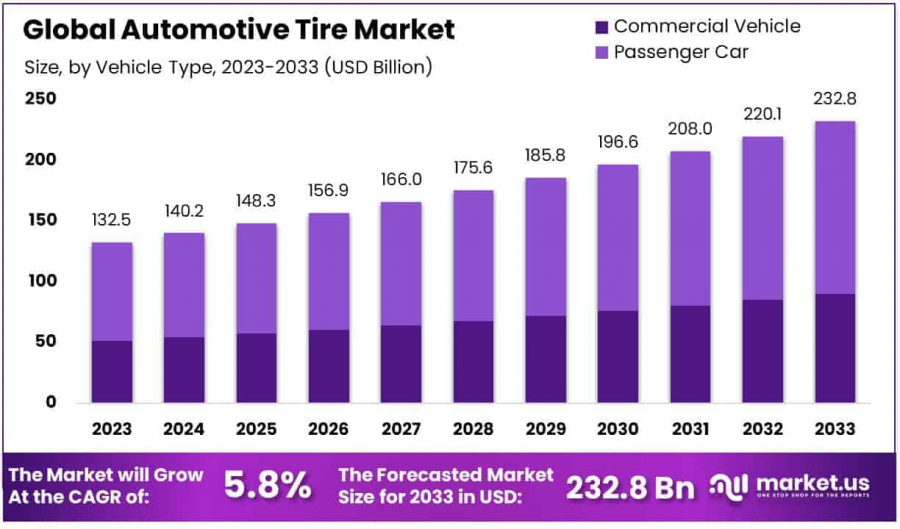

Automotive Tire Market to Reach USD 232.8 Billion by 2033 Driven by Rising Vehicle Ownership and Advanced Technologies

Automotive Tire Market size is expected to be worth around USD 232.8 Bn by 2033, from USD 132.5 Bn in 2023, growing at CAGR of 5.8% during the forecast period.

NEW YORK, NY, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- Report Overview

According to the report by Market.us, the Global Automotive Tire Market is projected to expand significantly, with its size expected to grow from USD 132.5 Billion in 2023 to approximately USD 232.8 Billion by 2033, reflecting a steady CAGR of 5.8% during the forecast period from 2024 to 2033.

This expansive market encompasses the manufacturing, distribution, and sale of tires tailored for a diverse array of vehicles, including passenger cars, commercial vehicles, buses, and more. Automotive tires, which are designed to provide optimal traction, durability, and comfort under various driving conditions, are central to vehicle safety and performance. The market report highlights the increasing demand for advanced tire technologies driven by rising vehicle ownership rates globally—91.7% of U.S. households owned at least one vehicle in 2022—and the continuous need for tire replacements and upgrades.

Significant growth is observed in North America, where the market holds a commanding 46.2% share, equating to roughly USD 61.2 Billion, due to strong consumer preferences for high-performance and premium tires, as well as robust automotive manufacturing. The report also details how key regions like Europe, Asia Pacific, Middle East & Africa, and Latin America contribute to the market with their unique dynamics, regulatory landscapes, and consumer preferences, underscoring the importance of regional analysis in understanding market trends.

Manufacturers are investing heavily in innovation, especially in developing sustainable and smart tire technologies such as run-flat tires, while also navigating challenges like high raw material costs and supply chain disruptions. This comprehensive analysis serves as an essential guide for stakeholders, detailing market segmentation, growth drivers, restraints, opportunities, and competitive strategies within the dynamic automotive tire landscape.

Want Deeper Insights? Explore Our Report Samples and Take Action Today - https://market.us/report/automotive-tire-market/request-sample/

Key Takeaways

- The Automotive Tire Market, valued at USD 132.5 billion in 2023, is expected to nearly double to USD 232.8 billion by 2033 with a CAGR of 5.8%, driven by rising vehicle ownership, technological innovations such as run-flat and eco-friendly tires, and increased demand in the aftermarket segment despite challenges like high raw material costs and supply chain disruptions.

- All-season tires dominate with 55.4% market share due to their versatility and year-round utility, while rims sized 16"-18" lead with 31.6% as they balance performance, aesthetics, and compatibility with a wide range of vehicles.

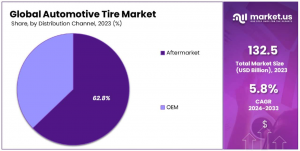

- Passenger cars remain the predominant vehicle type at 61.3%, and the aftermarket holds a majority with 62.8% distribution channel share, reflecting strong demand for replacements and upgrades, particularly in North America which dominates the market with a 46.2% share, indicating robust regional market strength and consumer spending on tire products.

Regional Analysis

North America dominates the Automotive Tire Market, holding a commanding 46.2% share which equates to approximately USD 61.2 billion. This regional leadership is driven by high vehicle production volumes, strong consumer demand for premium and high-performance tires, and advanced manufacturing capabilities that focus on innovation in tire technology. The U.S. and Canada, in particular, benefit from a mature automotive sector, high disposable incomes, and stringent safety and environmental regulations that spur the development and adoption of safer and more sustainable tire products.

Additionally, well-established distribution networks and a robust aftermarket for tire replacements support sustained regional growth. While North America leads the market, other regions like Europe, Asia Pacific, Middle East & Africa, and Latin America contribute significantly, each bringing unique characteristics such as regulatory support in Europe, rapid industrialization in Asia Pacific, and emerging vehicle markets in Latin America. These factors collectively shape the dynamic global landscape of the automotive tire market, with North America at the forefront of market activity.

Report Segmentation

By Season Tire Type

The segmentation by season tire type divides the market into summer, winter, and all-season tires. All-season tires currently dominate with 55.4% market share in 2023 due to their adaptability to various weather conditions, which eliminates the need for seasonal tire changes. This versatility appeals to a broad consumer base looking for cost-effective and reliable tire solutions throughout the year. Summer tires, engineered for optimal performance in warm conditions, cater to driving enthusiasts and high-performance vehicles but face limitations in colder climates.

Winter tires, specifically designed to handle snow, ice, and low temperatures, are essential for safety in cold climates but have a restricted market due to their seasonal use. Each tire type requires tailored manufacturing processes, materials, and design features to meet specific performance criteria and regulatory standards. Manufacturers focus on innovation in tread design, rubber compounds, and sustainability across these categories to improve safety, durability, and fuel efficiency. This segmentation offers insights into consumer preferences, seasonal demand fluctuations, and opportunities for product differentiation and marketing strategies within the tire industry.

By Rim Size

Segmenting by rim size examines how various rim dimensions—<15", 16"-18", 19"-21", and >21"—impact market dynamics. Rims sized 16"-18" dominate with 31.6% of the market, reflecting their popularity among a wide range of vehicles due to a balanced combination of aesthetics, performance, and affordability. These sizes offer optimal handling and comfort and are compatible with many passenger cars and light commercial vehicles. Smaller rim sizes (<15") are typically found on economy vehicles, emphasizing fuel efficiency and cost-effectiveness.

Larger rim sizes (19"-21" and above 21") cater to high-performance and luxury segments, providing enhanced driving dynamics and visual appeal, though often at the cost of increased wear and price. Manufacturers tailor tire designs to fit these rim sizes, optimizing for load capacity, ride comfort, and performance characteristics. Innovation in rim and tire technology, such as lightweight materials and aerodynamic designs, is particularly focused on the 16"-18" segment due to its significant market share. This segmentation underscores consumer preferences for certain rim sizes based on vehicle type, driving conditions, and aesthetic considerations, guiding manufacturers in product development and marketing strategies.

By Vehicle Type

Segmenting the market by vehicle type categorizes demand among commercial vehicles, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and passenger cars. Passenger cars make up the largest share at 61.3%, driven by global proliferation of personal vehicles and frequent tire replacement needs due to high mileage and wear. This dominance underscores the vast scale of the market and the critical role of passenger vehicle tires in revenue generation.

Light and heavy commercial vehicles, though representing smaller segments compared to passenger cars, require specialized tires engineered for durability, high load capacity, and extended tread life due to the demanding nature of commercial operations. Commercial vehicles overall drive a steady demand for high-performance, long-lasting tires designed to optimize fuel efficiency and reduce downtime. Each vehicle category has unique requirements regarding tire composition, tread patterns, and safety features, which manufacturers address through targeted research and development. Understanding these distinctions helps companies tailor their product portfolios, marketing efforts, and distribution strategies to meet the specific needs of each vehicle type, ensuring optimized performance and customer satisfaction across the automotive tire spectrum.

By Distribution Channel

The distribution channel segmentation distinguishes between aftermarket and OEM channels, with the aftermarket holding a dominant 62.8% share. The aftermarket channel serves consumers seeking replacement tires, upgrades, and specialized tire solutions after the initial sale of their vehicles. This channel thrives on the continuous need for tire maintenance, replacement cycles, and the desire for performance improvement or customization. It features a vast network of retail stores, service centers, online platforms, and specialized tire shops offering a wide variety of products and competitive pricing. The OEM channel, although smaller, is critical during the initial vehicle manufacturing process, ensuring that new vehicles are equipped with tires that meet the required safety and performance standards.

OEM partnerships often lead to bulk purchasing agreements and long-term supply contracts that provide stability and consistency. The aftermarket’s larger share reflects consumers’ preferences for flexibility, variety, and personalized service when replacing tires. Manufacturers and distributors invest in robust supply chains, marketing strategies, and technology platforms to enhance customer experience, streamline ordering processes, and provide value-added services like installation, disposal, and recycling of old tires. This segmentation sheds light on purchasing behaviors, channel strategies, and revenue streams in the automotive tire market.

Purchase the Complete Report Now with up to 30% off at https://market.us/purchase-report/?report_id=22409

Key Market Segments

By Season Tire Type

- Summer

- Winter

- All-season

By Rim Size

- <15"

- 16"-18"

- 19"-21"

- >21"

By Vehicle Type

- Commercial Vehicle

- Light Commercial

- Heavy Commercial

- Passenger Car

By Distribution Channel

- Aftermarket

- OEM

Driving Factors

The Automotive Tire Market is primarily driven by rising vehicle production and increased vehicle ownership globally, which fuel demand for new tires and replacement products. As automobile sales surge, so does the need for tires that are durable, fuel-efficient, and compliant with stringent safety standards. Technological advancements in tire manufacturing, such as the development of run-flat and eco-friendly tires, enhance performance and appeal to eco-conscious consumers.

Furthermore, government regulations aimed at reducing vehicular emissions promote the adoption of tires that improve fuel efficiency and reduce rolling resistance. Another significant factor is the growth of the aftermarket sector, where increasing vehicle age and rising maintenance needs drive continual replacement demand. Alongside these, strategic partnerships between tire manufacturers and automotive companies, coupled with innovative marketing strategies, bolster market penetration. As economies expand and new markets emerge, particularly in Asia Pacific and Latin America, the automotive tire industry continues to experience robust growth due to expanding infrastructure and heightened consumer spending on quality automotive parts.

Restraining Factors

Despite positive growth prospects, the Automotive Tire Market faces several challenges that can restrain expansion. High manufacturing costs, driven by expensive raw materials such as natural and synthetic rubber, and steel, can squeeze profit margins and lead to higher retail prices, deterring price-sensitive consumers. Complexity in tire design and the need for compliance with varying regulatory standards across regions add to production and certification costs.

The market also contends with saturation in developed regions, where intense competition and established brands make significant market share gains difficult. Fluctuations in raw material prices, supply chain disruptions, and geopolitical tensions can affect production stability and price volatility. Additionally, consumer shift toward alternative mobility solutions, such as electric vehicles, demands new tire technologies, requiring substantial R&D investment. Environmental concerns and regulations about tire disposal and recycling present further hurdles, compelling manufacturers to invest in sustainable practices and innovative recycling processes, which can slow down short-term growth and increase operational complexities.

Want Deeper Insights? Explore Our Report Samples and Take Action Today - https://market.us/report/automotive-tire-market/request-sample/

Trending Factors

The Automotive Tire Market is influenced by several emerging trends that are shaping its future. One prominent trend is the shift towards sustainable and eco-friendly tire production, utilizing bio-based materials and designing for recyclability to meet stringent environmental regulations and consumer demand for green products. Another key trend is the development of smart tires embedded with sensors that monitor pressure, temperature, and wear, enhancing vehicle safety and performance through real-time data analytics.

The rise of electric and autonomous vehicles drives innovation in tire technology, as these vehicles require specialized tires with low rolling resistance and enhanced durability. Additionally, manufacturers are leveraging digital transformation and e-commerce to streamline distribution and personalize customer experiences. Customization and premiumization of tires, driven by consumer preferences for high-performance and luxury vehicles, are also on the rise. These trends demonstrate an industry moving towards smarter, greener, and more customer-centric solutions, adapting to technological and environmental changes in the automotive landscape.

Investment Opportunities

Investment opportunities in the Automotive Tire Market are multifaceted, offering potential for significant returns. Companies focusing on R&D for sustainable tire materials and recycling technologies can tap into the increasing demand for eco-friendly products. Investments in smart tire technology, including sensor integration and AI analytics for predictive maintenance, present a burgeoning field as connected vehicles become more prevalent.

Expanding manufacturing capacity in emerging markets, particularly in Asia Pacific, can capitalize on growing vehicle production and rising consumer spending. Strategic partnerships with automotive OEMs to develop tires optimized for electric and autonomous vehicles also offer lucrative prospects. Additionally, digital transformation in sales channels, such as enhancing online platforms and leveraging big data for personalized marketing, can expand market reach and efficiency. Investors can also look into mergers and acquisitions to consolidate market positions, streamline supply chains, and reduce costs. These opportunities, coupled with a focus on innovation and sustainability, position stakeholders to drive growth and capture new market segments.

Market Companies

The Global Automotive Tire Market is characterized by intense competition among key players who continuously innovate to capture market share. Leading companies such as Bridgestone Corporation, Continental AG, Cooper Tire & Rubber Company, and Goodyear Tire & Rubber Company dominate the landscape, driving advancements in tire technology, sustainability, and smart features like run-flat capabilities. These top-tier manufacturers maintain expansive product portfolios that cater to a wide range of vehicle types, rim sizes, and seasonal requirements. They invest heavily in research and development to enhance performance, durability, and safety while also meeting stringent environmental standards.

Key Players

- B.V.Bridgestone Corporation

- Continental AG

- Cooper Tire & Rubber Company

- Goodyear Tire & Rubber Company

- Hankook Tire Group

- Michelin

- MRF (Madras Rubber Factory Limited)

- Pirelli & C SpA

- Apollo Tires

- Yokohama Rubber Co. Ltd

- Sumitomo Rubber Industries Ltd

- Toyo Tire Corporation

Conclusion

The Automotive Tire Market is poised for robust growth amid evolving consumer demands and technological advancements. While challenges like high raw material costs, regulatory compliance, and market saturation in developed regions persist, opportunities abound through sustainable innovations, smart tire technologies, and expansion into emerging markets. The industry’s focus on eco-friendly materials and integration with electric and autonomous vehicle trends highlights a transformative shift towards greener, smarter products.

Investment in R&D, strategic alliances, and digital sales channels can drive competitive advantage and market penetration. Despite potential restraints, the market’s adaptability to changing automotive landscapes and consumer preferences ensures its resilience. In conclusion, the Automotive Tire Market presents a dynamic environment where innovation, sustainability, and strategic investment pave the way for continued growth and long-term success, meeting the demands of a rapidly changing global transportation sector.

Related Reports

Authorized Car Service Center Market - https://market.us/report/authorized-car-service-center-market/

Truck-As-A-Service (TaaS) Market - https://market.us/report/truck-as-a-service-taas-market/

Crane Market - https://market.us/report/crane-market/

Car Detailing Service Market - https://market.us/report/car-detailing-service-market/

Specialty Commercial Vehicle Market - https://market.us/report/specialty-commercial-vehicle-market/

Semi-Trailer Market - https://market.us/report/semi-trailer-market/

Freight Trucking Market - https://market.us/report/freight-trucking-market/

Class 2 Trucks Market - https://market.us/report/class-2-trucks-market/

Heavy-duty Vehicle Rental Market - https://market.us/report/heavy-duty-vehicle-rental-market/

Multi Utility Vehicle (MUV) Rental Market - https://market.us/report/multi-utility-vehicle-muv-rental-market/

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Automotive Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release