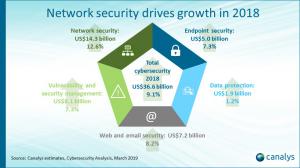

Canalys: Cybersecurity market grows 9% in 2018 to reach US$37 billion

The standout segment was network security, which was up 12.6% year on year, thanks to the creation of hybrid and complex environments.

Web and email security products grew 8.2%, followed by endpoint security, and vulnerability and security management solutions, both growing 7.3%. Growth rates within the different regions were similar, ranging from 7.0% in APAC to 10.5% in EMEA, with Latin America at 9.2% and North America 8.9%.

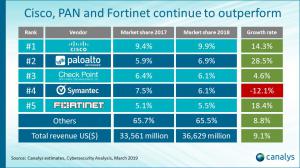

Cisco, Palo Alto Networks and Fortinet, all with a strong focus on network security products, outperformed the market, recording strong double-digit growth. “The fast adoption of multiple cloud services by enterprises, which often keep on-premises infrastructure as well, has created hybrid environments, complex to define and protect. This is driving growth for network security products, especially those solutions that enable the creation of a perimeterless architecture, favoring vendors with a wide array of tools in their portfolios,” said Canalys Research Analyst Claudio Stahnke.

Check Point was in third place, growing 5% thanks to its cloud security offering, which was recently expanded in identity management and web security with the acquisitions of Dome9 and ForceNock respectively. Finally, Symantec is expected to rebound this year after declining 12% in 2018, closing a difficult period after the fallout from an internal probe affected sales.

“We have seen many acquisitions in the cybersecurity space in 2018 as vendors are expanding their offerings to profit from the complexities that end users are facing,” Stahnke added. “This will not stop in 2019 as the market remains highly fragmented and new threats force incumbents to further expand their platforms.”

Cybersecurity quarterly estimate data is taken from Canalys’ Cybersecurity Analysis service. Estimates include technologies across network security, endpoint security, web and email security, data security, and vulnerability and analytics security. The subscription service tracks the transition of deployment options from hardware and software to services, public cloud workloads and virtual appliances/agents by channel and end-user size.

Rachel Lashford

Canalys

+44 7775 503940

email us here

Visit us on social media:

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.