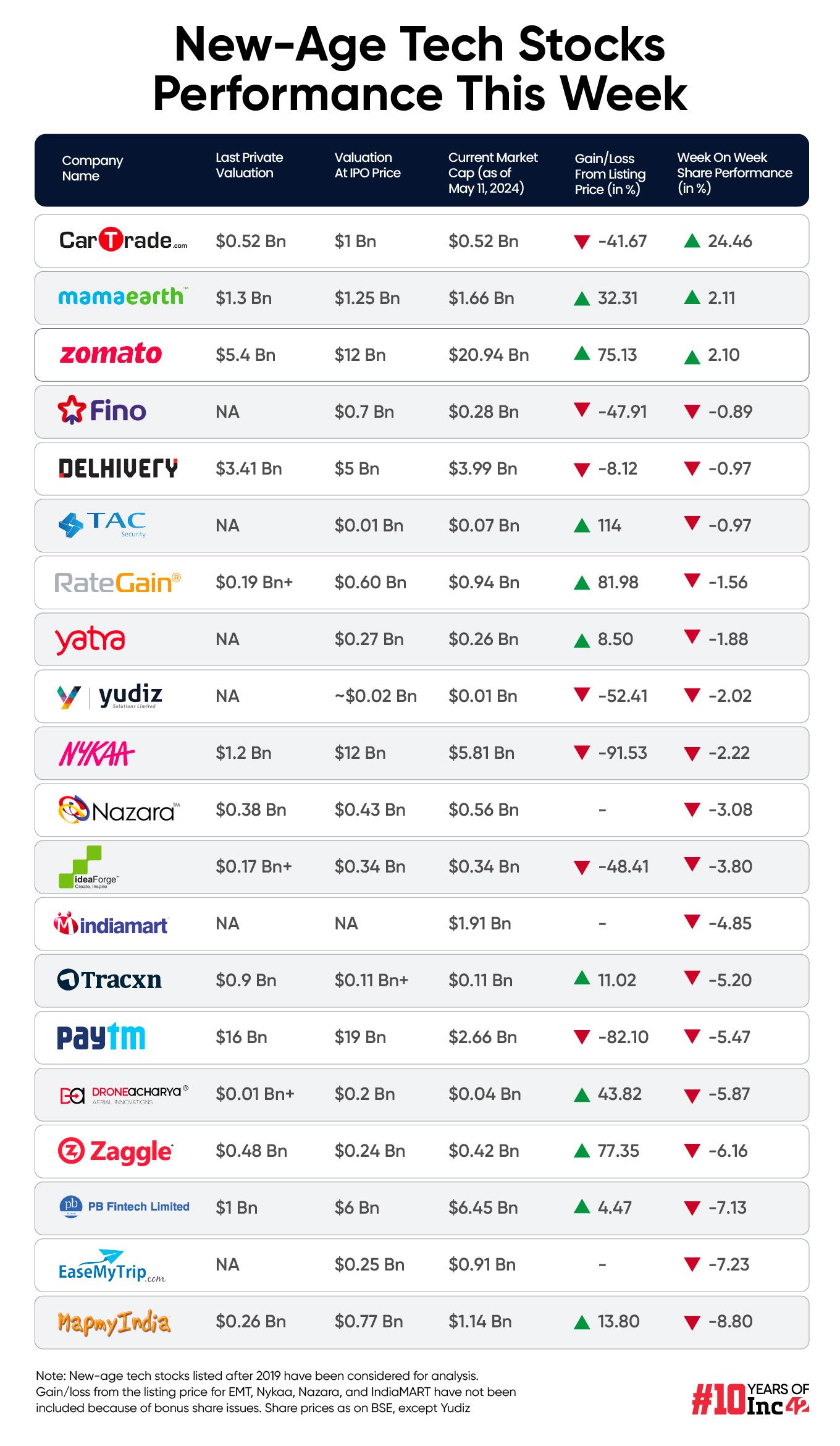

Seventeen out of the 20 new-age tech stocks under Inc42’s coverage fell this week in a range of 0.8% to 9% on the BSE, with MapmyIndia emerging as the biggest loser

CarTrade emerged as the top gainer as its shares jumped 24.5% on the BSE. Mamaearth and Zomato were the two other gainers this week

In the broader market, benchmark indices Sensex and Nifty50 slumped 1.64% and 1.87%, respectively, amid worries about the outcome of the 2024 general elections

Indian new-age tech stocks nosedived this week on the back of a slump in the broader equity market amid worries about the outcome of the 2024 general elections.

Seventeen out of the 20 new-age tech stocks under Inc42’s coverage fell this week in a range of 0.8% to 9% on the BSE, with MapmyIndia emerging as the biggest loser with an 8.8% fall.

Shares of EaseMyTrip and PB Fintech fell over 7% each, Zaggle declined 6.2%, while DroneAcharya, Paytm, and Tracxn slumped over 5% each on the BSE.

Nazara, Yudiz, Yatra, Nykaa, and ideaForge were also among the losers this week. Recently-listed TAC Infosec also reversed its three-week streak of emerging as the top gainer among the new-age tech stocks, as it fell about 1% on the NSE this week.

Meanwhile, helped by strong quarterly results, CarTrade emerged as the top gainer as its shares jumped 24.5% on the BSE during the week. Mamaearth and Zomato were the two other gainers, with their shares training 2% each.

In the broader market, benchmark indices Sensex and Nifty50 slumped 1.64% and 1.87%, respectively. However, after falling sharply in four trading sessions during the week, the indices gained marginally on Friday. Sensex closed at 72,664.47 and Nifty50 at 22,055.20.

Vinod Nair, head of research at Geojit Financial Services said that the Indian markets largely exhibited a downward trend throughout the week. He said this signals that investors are opting to sell after rallies.

“This inclination stems from the domestic market’s premium valuation and concerns surrounding the elections due to a lower voter turnout,” he said.

He also said that despite Q4 domestic earnings largely meeting expectations, there is a noticeable moderation in the overall earnings landscape.

“We expect the current trend in the domestic markets to continue in the short term due to election-led uncertainties. In the data-hectic week ahead, investor attention will be focused on the release of India and the US CPI data, Europe and Japan’s GDP releases, and the Fed chair speech,” Nair added.

Mahavir Lunawat, MD of Pantomath Capital Advisors, also said that the market will remain volatile due to pre-election jitters, geopolitical tensions, global economic slowdown, and delay in interest rate cuts.

Interestingly, despite the current volatility and selling pressure, the domestic IPO market is seeing a lot of action. Two more new-age tech stocks are getting ready to list on the stock exchanges soon.

The IPO of B2B travel portal Travel Boutique Online or TBO Tek, which opened earlier this week, closed with 86.7X subscription. On the other hand, insurance tech unicorn Digit Insurance is launching its INR 2,600 Cr+ public issue next week on May 15. The startup is aiming to list on exchanges on May 23.

Now, let’s take a look at the performance of some of the new-age tech stocks this week.

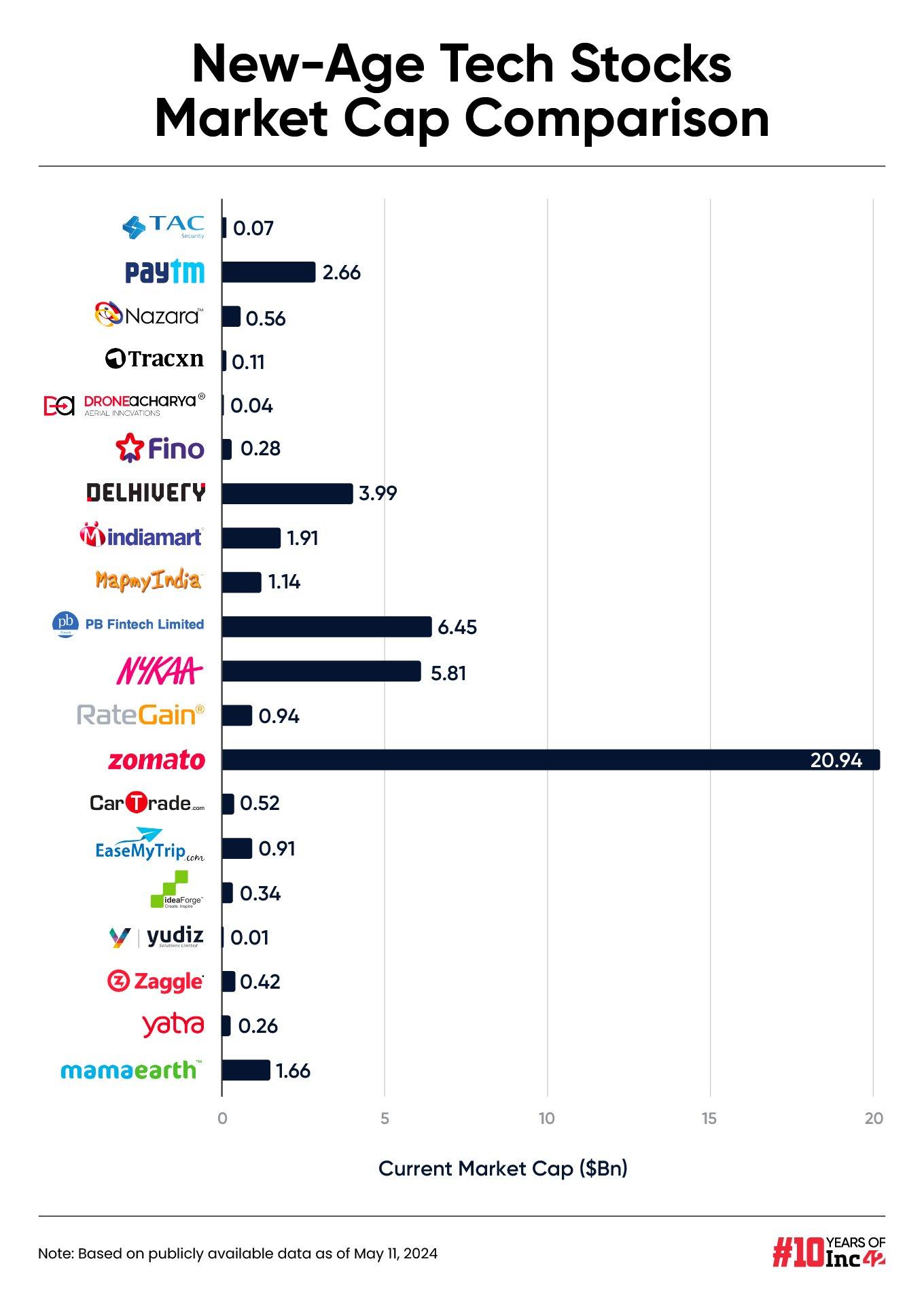

The 20 new-age tech stocks ended this week with a total market capitalisation of $49.02 Bn.

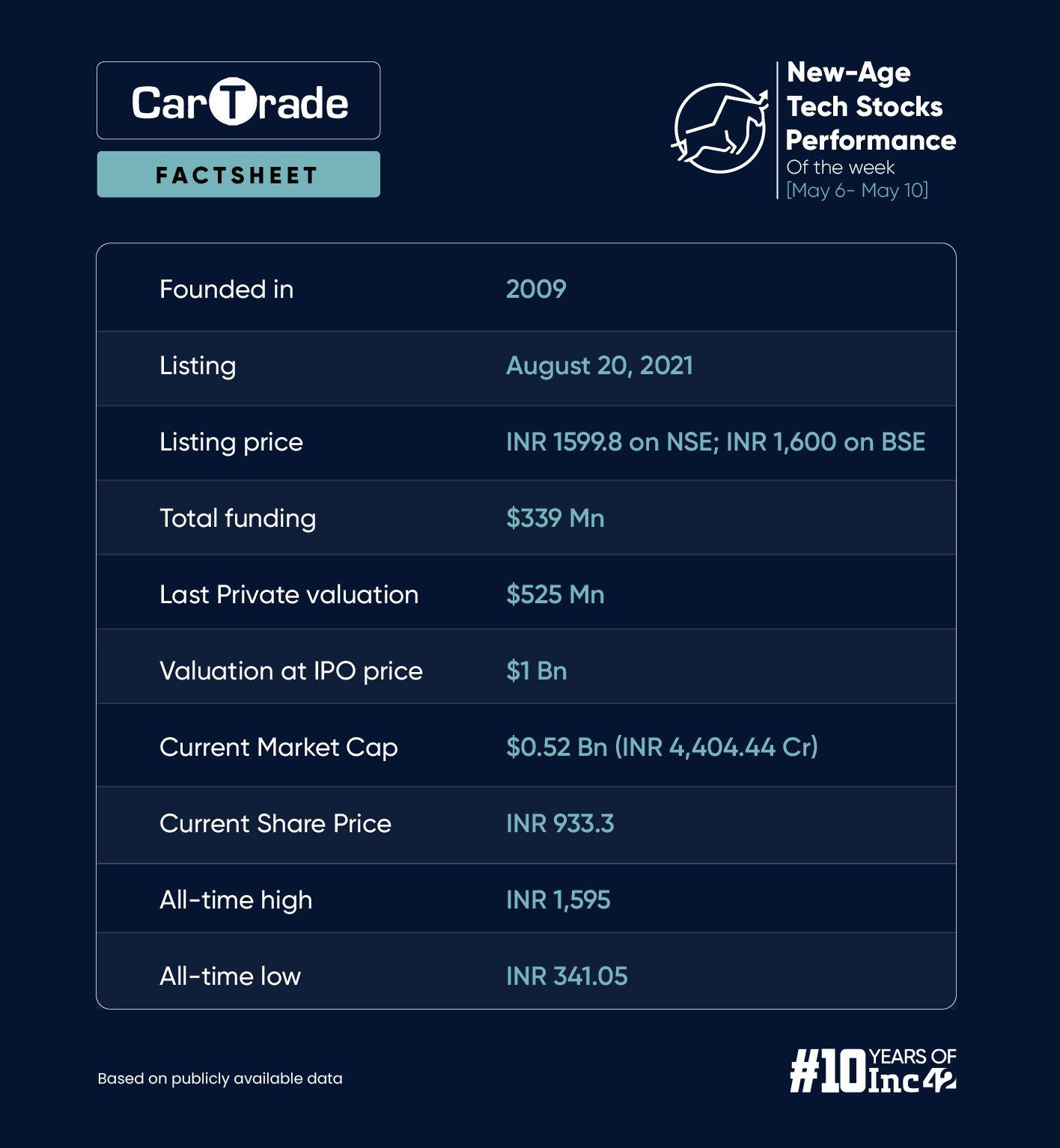

CarTrade’s Strong Q4 Show

Shares of CarTrade rallied over 24% this week as the company reported a profit after tax (PAT) of INR 25 Cr in Q4 FY24 against a loss of INR 23.5 Cr in Q3 FY24.

The company’s shares rose sharply in three consecutive sessions and also touched a 52-week high of INR 974 on Wednesday (May 8).

CarTrade ended the week at INR 933 on the BSE, closing at the highest level since December 2021.

With the fundamentals improving again, Goldman Sachs Asset Management BV increased its stake in the startup to 5.15% this week, becoming a substantial shareholder.

Reiterating its ‘buy’ rating on the stock and target price of INR 1,020, JM Financial said the company is perfectly positioned to benefit from rising digitalisation in the Indian auto sector.

“We expect India’s used items (including used auto) market to grow strongly with consumers rising over the taboo of owning a used item. OLX, being the undisputed market leader, is expected to deliver 18-22% revenue growth along with sustained market expansion,” said the brokerage.

Rupak De, senior technical analyst at LKP Securities, said, CarTrade is looking strong on the charts. The stock might move towards INR 1,000 mark in the near term. The support for the stock is at INR 900.

No Relief For Paytm

Shares of Paytm continued to remain under significant selling pressure following top-level exits in the company last week.

The stock touched an all-time low this week at INR 310 on the BSE on Thursday (May 9). However, it slightly recovered and jumped 5% on Friday, ending the week at INR 349.95.

Overall, it fell 5.5% this week.

In The News For:

- Exit of Paytm COO and president Bhavesh Gupta last week

- Paytm Payments Bank (PPBL) moving its bill payment operations to Euronet Services India

- Paytm denying an ET report that claimed Aditya Birla Finance invoked loan guarantees which the fintech major had provided to the lender in lieu of repayment defaults from customers

- Paytm’s plans to venture into the ride-hailing space by offering auto rickshaw booking services through the ONDC

Shares of Paytm have more than halved since the beginning of February after the Reserve Bank of India (RBI) announced a number of restrictions on Paytm Payments Bank.

LKP’s De said that Paytm remains a ‘sell on rally’ stock. “… sellers will return at higher levels. On the other hand, a short-term trader might consider buying this stock with a stop loss at INR 334 for an upside target of 368-390,” he added.

PB Fintech’s Q4 Results Fail To Excite The Market

The parent of Policybazaar and Paisabazaar reported a net profit of INR 60.2 Cr in Q4 compared to a loss of INR 9.3 Cr in the year-ago quarter. On a quarter-on-quarter (QoQ) basis, PB Fintech’s profit jumped almost 62%.

Its operating revenue increased 25% on both QoQ and YoY basis to INR 1,089.6 Cr in the reported quarter.

Despite reporting a strong quarter, shares of PB Fintech fell sharply this week. Overall, the stock plummeted 7.1%, ending the week at INR 1,201.45 on the BSE.

LKP’s De said that the stock looks weak on the technical charts and might fall towards INR 1,150-INR 1,100 levels. It will face resistance at INR 1,240.

Shares of PB Fintech have gained over 51% year to date.

Ad-lite browsing experience

Ad-lite browsing experience